Most algorithmic trading providers offer algos as one of hundreds, sometimes thousands, of products and services across dozens of business units. With so much distraction, how can management of these complex organizations – even with best intentions – understand much less focus their energy sufficiently to offer the best products? Further, many of these organizations must contend with legacy technology investments that are years old.

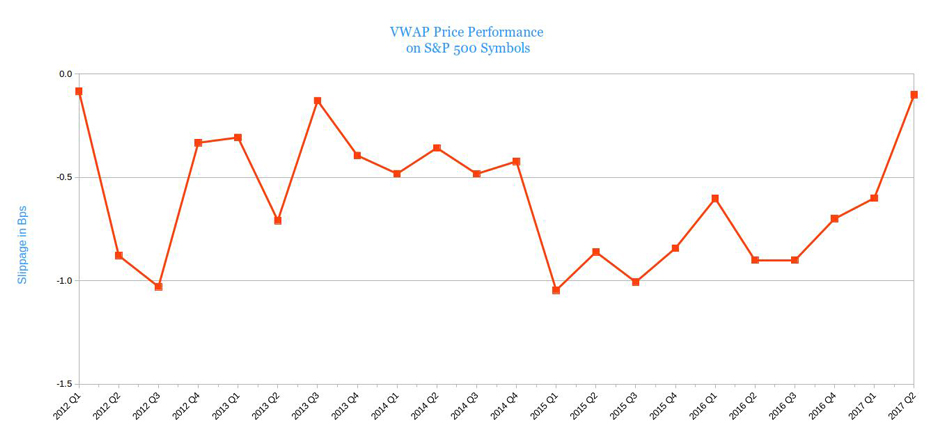

Our algorithms consistently have excellent price performance. About our technology >

At its highs, Deep Value has averaged 11% of the overall market in the top 250 NYSE-listed stocks towards the end of each trading day – a critical time for algo trading. Our systems have routinely managed more than 30,000 orders concurrently, making us trusted guardians of customers’ order flow – no matter how large. Since 2010, Deep Value has traded over 60B shares and two trillion dollars in the aggregate in US cash equities.